- Should you ever be greedy with your gains or hold your winners for a grand slam?

- How to deal with difficult trading decisions…

Hey, Evolver.

Follow along with me here…

Let’s say you’re in a trade. You’re green on the day, but you think the chart pattern could continue in your favor. You have a strong conviction in the pattern playing out, but it’s taking longer than you anticipated.

The end of the trading day is drawing near, and you need to make a tough decision…

To hold or not to hold? That is the question that has been running through traders’ minds since the early days of risk assets.

Holding vs. not holding is one of the most difficult decisions traders have to make. If you’re staring at unrealized gains, do you take your win and call it a day? Or hold for a potential grand slam?

Let’s break it down.

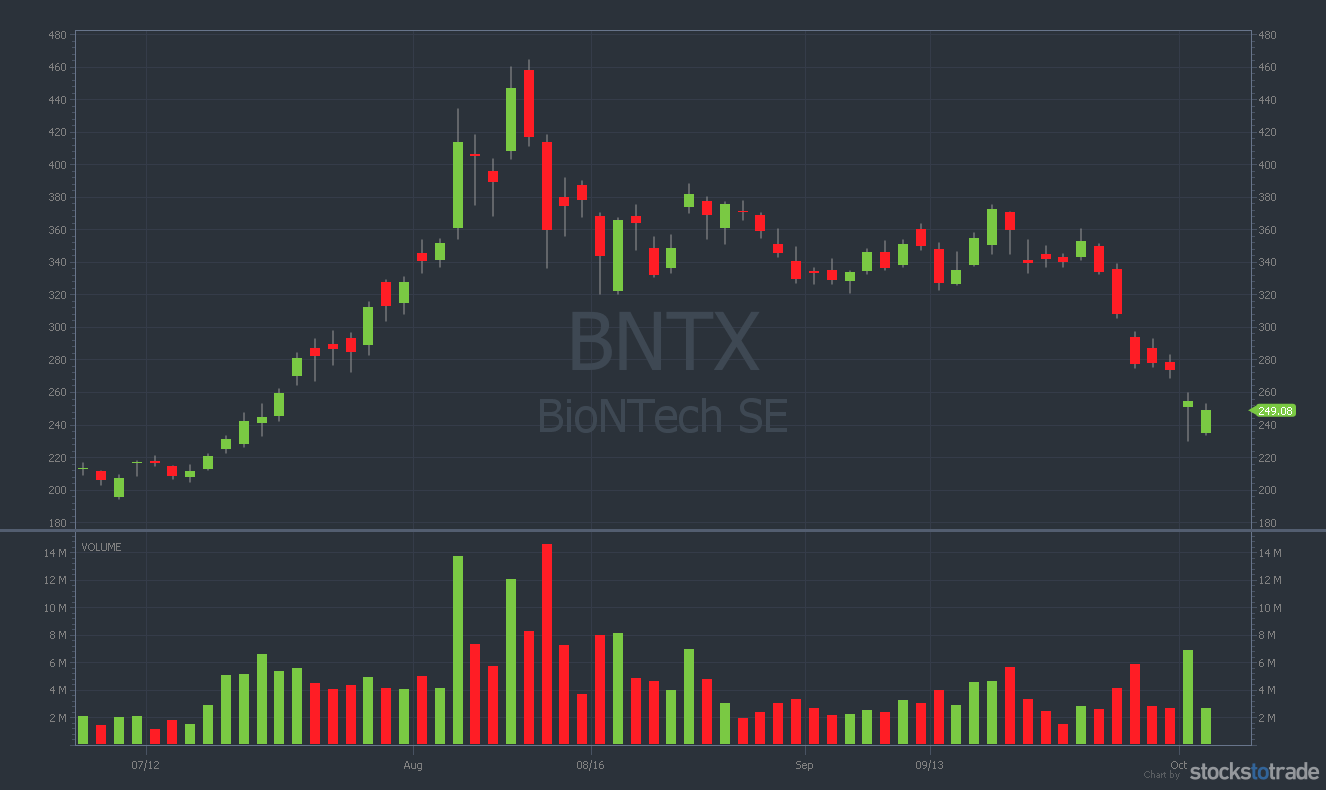

BNTX: A Perfect Setup

I dealt with this exact question while trading BioNTech SE (NASDAQ: BNTX) puts last week. I’ve been watching this chart for months. I know its unique personality.

The daily chart has been in a steady downtrend since the stock hit a blow-off top at $464 on August 10.

But in the past month, BNTX has found strong support near $325. (It hasn’t closed below this level since mid-August.)

Naturally, I had this level bookmarked. If BNTX broke below it, I knew the price action would be ripe for put trading.

Last Monday, September 27, this is exactly what happened. By mid-morning, I could feel the weakness. As I was gearing up to buy puts, I alerted the $320 support area to watch for a crack. I also alerted a risk area of $330 vs. a price target of $300.

Then, 10 minutes later, I bought 25 BNTX 10/1 $300 puts. These contracts gave me until Friday to hit my target, and I planned on holding as strong as I could.

Spoiler alert: It didn’t take until Friday.

Letting Winners Ride

Just hours later, my puts were deep in the green as BNTX plunged through $325.

This is where the big decision comes for any trader. You have two choices:

- Be greedy with your gains. Sell it all. Take the money and run.

- Sell some of your position — but hold the rest overnight for a potential grand slam.

90% of the time, I recommend option A. In general, it’s best to lock in profits on your winning trades — before they evaporate.

That said, it’s moments like these where the art of technical analysis comes into focus.

If you’ve studied chart patterns as much as I have, you may be able to pick out the rare, overnight-hold, grand-slam winner.

10% of the time, you need the guts to go with option B. It’s this decision-making process that separates expert traders — like Tim Sykes — from the rest of the crowd.

Having the conviction to hold a winner isn’t easy. It’s really difficult. But missing that grand slam is almost as bad as losing money. Keyword: almost.

I chose option A for BNTX. I sold my puts before the close of trading on Monday for a profit of $21,040.*

This was a great trade, but I’m very self-critical. I can’t help it. Had I held until Friday, I could have made a small fortune.

It was still a win — but I missed a massive cherry on top of my trade.*

Lesson Summary

- In hindsight, I should have held my BNTX puts overnight…

- I had several days left on my contracts, but I took the safe route instead of going for the grand slam…

- When the ideal setup starts to play out just as you expect, be prepared to hold longer than you normally do…

Conclusion

All in all, this was a fantastic trade. I’d been eyeing this chart for a long time, and I was rewarded for trading on my strong conviction.*

But I’m tough on myself. I’m always hungry for more. Don’t get me wrong … I’m happy with the win. But from here on out, I’m even more motivated to avoid selling too early.

Congratulations and mazel tov to any Evolvers who profited from the BNTX play. It was a home run. But next time — I’m determined to hit a grand slam.

Keep swinging,

Mark Croock

Editor, Evolved Trader Daily

P.S.

*All content in this newsletter is intended for educational and informational purposes only.

The material in this newsletter is not to be construed as (i) a recommendation to buy or sell stocks, (ii) investment advice, or (iii) a representation that the investments being discussed are suitable or appropriate for any person. No representation is being made that following Evolved Trader Daily strategies will guarantee a particular outcome or result in profits. The price and value of stocks may fluctuate depending upon various market factors, and, as such, the strategies used by Evolved Trader Daily to adjust for those fluctuations may change without notice.

There are significant risks associated with trading stocks and you must be aware of those risks, and willing to accept them, in order to invest in these markets. Past performance of any trading system or methodology is not indicative of future results. You should always conduct your own analysis before making investments.

You should not trade with money you cannot afford to lose and there is a risk that trading stocks will result in a complete loss of your investment. Trading stocks, particularly penny stocks, is not suitable for everyone and requires hard work, due diligence, capital, and substantial time to monitor the market and timely execute trades.